⚠️ NOTICE: FundingTicks Has Ceased Operations

As of January 18, 2026, FundingTicks has ceased operations and is no longer in business. This article is kept live for historical and educational purposes only. If you are looking for active and reputable futures prop firms, view our prop firm list for updated alternatives.

Inside the Funding Ticks Zero Program

The FundingTicks Zero program stands out in the prop trading world because it eliminates the evaluation phase entirely. Most prop firms require traders to prove themselves through one or two evaluation steps before funding is granted. With Zero, you skip that process and begin directly in a funded Master account with simulated capital.

This structure is designed for traders who want to start earning right away. There’s no waiting period, no staged testing, and no evaluation hurdles. From day one, you’re in a profit-sharing account and eligible to request rewards as long as you follow the rules.

In this article, we’ll cover what the FundingTicks Zero program is, the rules you must follow, how payouts and rewards work, and why this straight-to-funded model may appeal to both beginners and experienced traders.

What the FundingTicks Zero program is

FundingTicks Zero is a straight-to-funded account program, which makes it very different from traditional evaluation models offered by many other prop firms. In most programs, traders are required to go through one or two evaluation steps where they must hit strict profit targets, avoid daily loss breaches, and sometimes meet time restrictions before ever becoming funded. These evaluations can be stressful and time-consuming, and even small mistakes can cause a reset.

This model appeals to both beginners and advanced traders for different reasons. New traders don’t have to stress over evaluation resets, while experienced traders can start trading right away without wasting time proving their strategy in a trial. By starting directly in a funded account, you can focus on what matters most — trading consistently, following risk rules, and reaching payout targets.

What Are the FundingTicks Zero Trading Rules?

FundingTicks Zero operates under specific trading rules that funded traders must follow to maintain account eligibility and receive profit payouts.

Maximum Loss Limit (End-of-Day Trailing Drawdown)

What is the maximum loss limit? The maximum loss limit is a trailing drawdown that follows your end-of-day account balance until it locks at breakeven.

Maximum loss limits by account size:

$25,000 account: $1,000 maximum loss

$50,000 account: $2,000 maximum loss

$100,000 account: $3,000 maximum loss

Contract Limits

Contract limits determine the maximum number of futures contracts you can hold open simultaneously in your trading account.

Contract limits by account size:

$25,000 account: 1 mini contract OR 10 micro contracts

$50,000 account: 3 mini contracts OR 30 micro contracts

$100,000 account: 5 mini contracts OR 50 micro contracts

News Trading Policy

Can you trade during news events? Yes, FundingTicks Zero allows trading during all market events including:

Economic news releases

Federal Reserve speeches

Earnings announcements

Major economic data releases

This flexibility sets FundingTicks Zero apart from prop firms that restrict news trading.

The 25% Consistency Score Rule

What is the consistency score? The consistency score is FundingTicks Zero's signature rule requiring that no single trading day can account for more than 25% of your total account profits.

How the 25% consistency rule works:

No individual day's profit can exceed 25% of your cumulative profits

If one day represents more than 25% of total profits, you must continue trading

Additional profitable days will reduce the percentage below the 25% threshold

This rule promotes consistent trading rather than relying on single large wins

Example: If you make $1,000 total profit, no single day can contribute more than $250 to that total.

Why These Rules Exist

These trading rules serve multiple purposes:

Risk management: Protect both trader and the prop firm

Sustainable trading: Encourage consistent, disciplined approaches

Long-term success: Prevent boom-bust trading cycles that lead to account losses

How Do FundingTicks Zero Payouts Work?

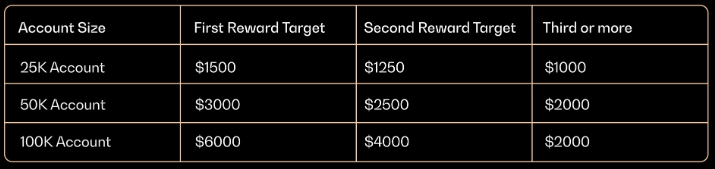

FundingTicks Zero offers one of the most competitive payout structures in the industry. With a 90% profit split, traders keep the majority of what they earn. Rewards can be requested weekly, provided rules are followed.

Reward Cycle

You can request a reward every 7 trading days.

At least 7 days must be logged in each cycle (even if it’s just opening and closing a single micro contract).

Rewards require reward targets to be met while keeping the 25% consistency score intact.

Image captured from FundingTicks

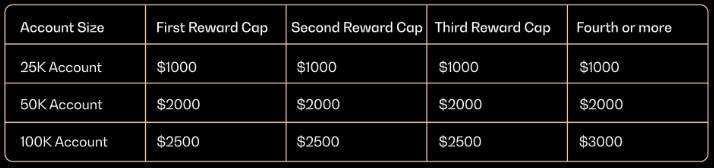

Reward Caps

The reward cap is the maximum amount of profit you can withdraw during each payout request cycle. Even if you generate more profit than the target requires, you can only withdraw up to the cap for that specific cycle.

Image captured from FundingTicks

This step-down structure encourages consistent growth. Rather than extracting profits too quickly, traders earn payouts in stages while building account balance steadily.

Final thoughts

FundingTicks Zero is more than just a shortcut past evaluations; it’s a streamlined way to step into funded trading from the very start. By combining a 25% consistency score, end-of-day trailing max loss, contract limits, and unrestricted news trading, the program balances freedom with accountability. The structure rewards discipline while still giving traders flexibility to trade their way.

What makes this program especially attractive is the payout model. With a 90% profit split and the ability to request rewards every 7 trading days, traders can see the benefits of their efforts quickly while maintaining a clear path toward long-term growth. Instead of worrying about resets or lengthy trial phases, you can focus on consistency and steady performance.

If you want to see how FundingTicks Zero stacks up against other firms, make sure to check out our prop firm comparison tool. For traders curious about how this model differs from FundingTicks other offerings, you can also read about the FundingTicks One Program or the FundingTicks Pro+ Program. Together, these three account types give traders a range of options depending on whether they prefer evaluations, advanced structures, or the direct to funded access that the FundingTicks Zero account provides.

Whichever path you choose, don’t forget to use code SOPF when signing up; it guarantees you the best deal available on FundingTicks programs.

FAQ: FundingTicks Zero Program

What is the FundingTicks Zero program?

The FundingTicks Zero program is a straight-to-funded model where traders begin in a Master account with simulated capital. There is no evaluation stage.

Does FundingTicks Zero require an evaluation?

No. FundingTicks Zero skips evaluations entirely, so traders can start directly in a funded account.

What is the consistency score in FundingTicks Zero?

The consistency score in FundingTicks Zero means no day’s profit can be more than 25% of your total profits. This rule ensures steady performance.

What are the maximum loss limits in FundingTicks Zero?

FundingTicks Zero has trailing end-of-day drawdowns: $1,000 for 25K, $2,000 for 50K, and $3,000 for 100K accounts.

What are the contract limits in FundingTicks Zero?

The FundingTicks Zero program allows 1 mini or 10 micros on 25K accounts, 3 minis or 30 micros on 50K accounts, and 5 minis or 50 micros on 100K accounts.

Can traders in FundingTicks Zero trade news events?

Yes. FundingTicks Zero allows traders to open, hold, and close positions during news events, announcements, and speeches without restrictions.

How often can payouts be requested in FundingTicks Zero?

Payouts in FundingTicks Zero can be requested after 7 trading days are logged, provided the consistency rule and minimum profit goals are met.

How does the reward split work in FundingTicks Zero?

FundingTicks Zero offers a 90% profit split in favor of the trader. The trader keeps 90% of their reward payout and FundingTicks keeps 10%. For example, if a trader requests a $1,000 reward payout, they will receive $900 (90%) while FundingTicks retains $100 (10%).

What are the reward caps in FundingTicks Zero?

Each payout request has a cap. On a 25K account, the first cap is $1,000, the second $1,000, and subsequent cycles continue at $1,000 caps.

Is FundingTicks Zero beginner-friendly?

Yes. FundingTicks Zero is beginner-friendly since it requires no evaluation, has clear rules, allows news trading, and offers one of the highest profit splits in the prop firm industry.

Why choose FundingTicks Zero over other programs?

FundingTicks Zero is attractive because it eliminates evaluations, allows unrestricted news trading, emphasizes consistency, and offers a 90% profit split.

Disclaimer: Prop firm rules and requirements change frequently. While this article reflects the most accurate information available at the time of writing, some details may become outdated. If you notice an error or need clarification, please contact us directly at https://saveonpropfirms.com/contact.

Complete LucidBlack Guide: 3-day Payouts & 2x Bonus System

Complete guide to LucidBlack covering 3-day payouts, 2x bonus system, evaluation rules, funded account requirements, 40% consistency, contract scaling, LucidLive transition, and detailed comparisons with LucidFlex, LucidPro, and LucidDirect.

Nexgen ProTrader Funding Evaluation Questions Answered

A complete breakdown of how the Nexgen ProTrader Funding evaluation works, covering account sizes, drawdown mechanics, trading rules, platforms, and what happens after you pass.

Best Nexgen ProTrader Funding Discount Code

Complete guide to the SOPF discount code for Nexgen ProTrader Funding. Learn how to save up to 90% on evaluations, when sales run, and how to apply the code.