MyFundedFutures is excited to announce the integration of dxFeed as its new data provider, replacing Rithmic and enhancing its options with dxFeed and Tradovate. This change is designed to improve the trading experience by offering access to superior, real-time market data, essential for making well-informed decisions in the dynamic world of futures trading. With dxFeed's accurate and dependable data feeds, MyFundedFutures empowers traders to develop effective strategies and manage risk more efficiently, catering to both beginners and seasoned professionals.

What is dxFeed?

dxFeed is a premier provider of real-time market data solutions, serving the needs of traders and financial institutions worldwide. Founded over a decade ago, dxFeed has become a trusted source for accurate, real-time market data and analytics, supporting a wide range of asset classes, including equities, futures, options, and cryptocurrencies. The company specializes in delivering data feeds that are critical for traders who require up-to-the-second information to execute trades and develop sophisticated trading strategies. Known for its reliability and precision, dxFeed is widely used by proprietary trading firms, brokers, and hedge funds to gain a competitive edge in the markets.

Over the years, dxFeed has built a robust infrastructure to ensure low-latency data delivery and high availability, making it a preferred choice for traders and institutions across North America, Europe, and Asia. With its comprehensive data solutions and strong focus on real-time market intelligence, dxFeed continues to empower traders with the information they need to navigate complex financial markets effectively.

Platforms Compatible with dxFeed

With the integration of dxFeed, MyFundedFutures now supports a variety of popular trading platforms that utilize this high-quality, real-time data feed. These platforms include:

Advanced Risk Controls with Volumetrica

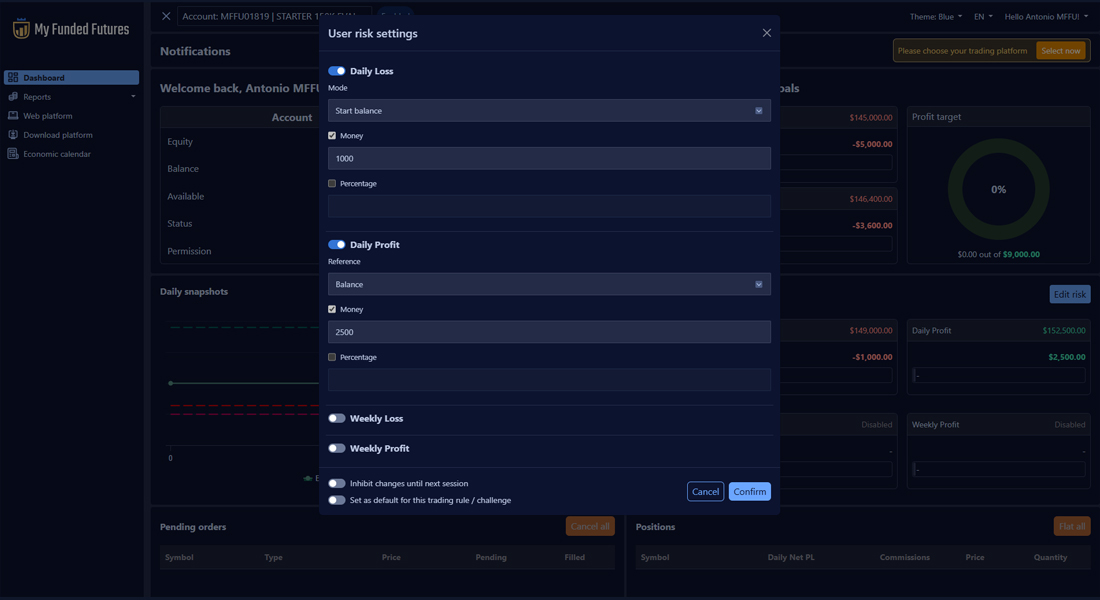

The Volumetrica platform offers traders advanced risk management controls to help maintain trading discipline and protect capital. It provides several key risk settings, allowing traders to tailor their risk management strategies to their specific needs:

Daily Profit Goal

Daily Loss Limit

Weekly Profit Goal

Weekly Loss Limit

Restrict Changes To Risk Controls Until Next Trading Session

These advanced risk controls are designed to support both novice and experienced traders in developing a structured approach to trading. By leveraging these settings, traders can reduce the risk of substantial losses and increase their potential for sustained profitability in the futures markets.

Special MyFundedFutures + dxFeed Offer

Traders making their first dxFeed account purchase with MyFundedFutures will receive a free account reset. Additionally, by using the promo code SOPF, you can enjoy a 5% discount off the advertised website price for all evaluations. This special offer provides a fantastic opportunity to experience the benefits of dxFeed's real-time data and advanced trading tools while saving money.

Who is MyFundedFutures?

For those unfamiliar with MyFundedFutures, it is a proprietary trading firm, or prop firm, that provides futures traders with the opportunity to trade using the firm's capital rather than their own. This model reduces financial risk for traders while providing access to significant capital, enabling more substantial trades and potentially higher returns. MyFundedFutures offers various evaluation programs to assess traders' skills. Those who pass these evaluations are given access to funded trading accounts, allowing them to trade on global futures markets without risking their own money.

For more information on how to start trading with MyFundedFutures and take advantage of their new dxFeed integration, visit their official website or check out their Help Center for detailed guides and support.

🚨 Save 5% at MyFundedFutures with promo code SOPF 🚨

The content of this article is derived from: MyFundedFutures, dxFeed, Volumetrica, Quantower, ATAS, Tradovate, and Rithmic. All product names, logos, and brands mentioned herein are the property of their respective owners.

Best Nexgen ProTrader Funding Discount Code

Complete guide to the SOPF discount code for Nexgen ProTrader Funding. Learn how to save up to 90% on evaluations, when sales run, and how to apply the code.

Best Alpha Futures Discount Code

Save on Alpha Futures evaluations with discount code SOPF. Complete pricing breakdown for all plans, activation fee details, step-by-step application guide, and promotional calendar. Get the best deal on your trading evaluation.

Nexgen ProTrader Funding Payout Requirements Guide

Complete guide to Nexgen ProTrader Funding payout requirements. Learn the 8 trading days rule, 30% consistency calculation, $600 buffer minimums, profit split progression from 90% to 100%, and how to avoid common payout mistakes that delay withdrawals.