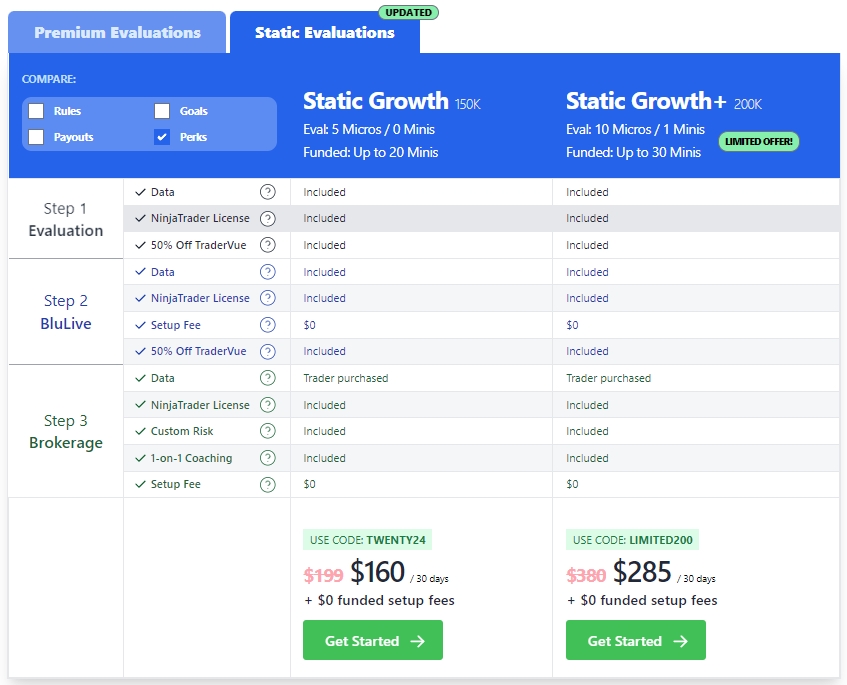

Unlock Your Trading Potential with BluSky's Static Growth+ 200K Account

In the world of futures trading, finding the right platform that aligns with your strategy and growth aspirations is crucial. BluSky Trading Company introduces the Static Growth+ 200K account, a revolutionary program designed to catapult your trading journey from novice to professional. Here’s why this account is not just another trading platform but a career-transforming opportunity.

Step 1: Evaluation Phase – Prove Your Mettle

Begin your journey with the Evaluation Phase. This stage is designed to assess your trading acumen without the pressure of daily loss limits. You’re provided with contracts of 1 mini or 10 micros, aiming for a $4000 profit goal with a generous allowance of a $2000 static drawdown. There’s no consistency requirement, and you only need one trading day to move forward.

Step 2: BluLive Phase – Transition to Real Success

After passing the evaluation, you advance to the BluLive Phase. Here, your contract size doubles to 2 minis or 20 micros. The rules remain supportive with a static drawdown of $2000 and no daily loss limits, but the profit goal is adjusted to $3000. Like before, only one trading day is required to complete this phase.

Step 3: Live Brokerage Account – Reap the Rewards

The final step is where your efforts pay off. Transition to a Live Brokerage Account with no setup fees and a starting balance of $3000. The only rule in brokerage is to maintain a minimum balance of $300, ensuring the account does not fall below this level. Enjoy the freedom to withdraw your earnings daily, with payouts available from Monday to Friday and no cap on the maximum amount.

Take the First Step Today

The BluSky Static Growth+ 200K account is not just a trading account; it's a pathway to professional growth and financial success. Don’t miss out on this opportunity to elevate your trading career. Let your trading skills shine with BluSky, and start on the path to a lucrative trading career.

Best Nexgen ProTrader Funding Discount Code

Complete guide to the SOPF discount code for Nexgen ProTrader Funding. Learn how to save up to 90% on evaluations, when sales run, and how to apply the code.

Best Alpha Futures Discount Code

Save on Alpha Futures evaluations with discount code SOPF. Complete pricing breakdown for all plans, activation fee details, step-by-step application guide, and promotional calendar. Get the best deal on your trading evaluation.

Nexgen ProTrader Funding Payout Requirements Guide

Complete guide to Nexgen ProTrader Funding payout requirements. Learn the 8 trading days rule, 30% consistency calculation, $600 buffer minimums, profit split progression from 90% to 100%, and how to avoid common payout mistakes that delay withdrawals.