Apex Trader Funding Payout Policy

The payout and withdrawal policy of Apex Trader Funding may seem confusing to some. In this article, we'll clarify every detail of the policy for complete understanding.

We will discuss the requirements for receiving payment, the timing for payment requests, the actual payment schedule, the maximum amount you can request, and the portion you retain.

Can I Receive Payouts from an Apex Trader Funding Evaluation Account?

No, Apex Trader Funding evaluation accounts do not qualify for payouts. To be eligible for payouts, you must first pass the evaluation by meeting the profit goal, avoiding the trailing drawdown limit, and trading for a minimum of seven days. Successful completion of these steps leads to a performance account (PA account), from which payouts can commence, provided you meet the necessary criteria. This structure ensures that payouts are reserved for those who have demonstrated skill and consistency in futures trading.

Apex Trader Funding Profit Share

Apex Trader Funding revolutionizes the futures trading landscape by enabling traders to keep 100% of their initial $25,000 in profits from each of up to twenty (20) distinct performance accounts, optimizing their trading strategies. Once traders surpass this profit margin, their earnings transition to a lucrative 90%/10% profit split, significantly enhancing the rewards for proactive futures trading across multiple accounts. In the event a performance account is blown, initiating a new account offers a clean financial restart. Every new account is treated as an independent entity, maintaining the trader's eligibility to secure 100% of the first $25,000 in profits again. This framework empowers futures traders in the Apex Trader Funding ecosystem to continuously evolve and refine their tactics, free from the constraints of previous account results, fostering an environment of growth and strategic development in futures trading.

Keep 100% of the first $25,000 per account, not per user.

After the first $25,000 the profit split goes to 90% Trader, 10% Apex Trader Funding.

Each account is a standalone account.

Apex Trader Funding Required Minimum Days for Payout

To qualify for your first payout from an Apex Trader Funding performance account, and for any subsequent payouts, you must engage in ten (10), separate trading days, with trades executed on each of these days. Each payout request must be spaced by at least ten (10) active trading days, regardless of whether previous requests were approved or denied.

First request required days: 10

Second+ request required days: 10

A trading day spans from 6:00 PM ET to 5:00 PM ET the following day, encompassing all trading activities during this timeframe. For instance, trades conducted on Sunday evening and Monday morning are treated as one (1) trading day, while trades on different mornings, such as Monday and Tuesday, count as two (2) separate trading days. Additionally, holidays with early market closures are consolidated with the subsequent trading day for settlement purposes. It's crucial to note this, especially on early close trading days.

Apex Trader Funding Consistency Rule - The 30% Rule

Withdrawal requests at Apex Trader Funding are governed by the 30% Rule, which mandates that no more than 30% of the total profit balance can come from a single trading day. This rule underscores the significance of effective risk mitigation, urging traders to diversify their profits and maintain consistency in their trading activities. If a trader's profits exceed the 30% threshold, their withdrawal request is likely to be denied, requiring them to continue trading until their best day aligns with the 30% consistency Rule. By establishing daily goals and adhering to disciplined trading practices, traders can protect their profits and promote steady growth, aligning with Apex Trader Funding's commitment to responsible and sustainable trading.

Consistency Percentage Calculation Formula: (Highest Single-Day Profit / Total Profits Earned) * 100 = Consistency %

Apex Trader Funding Flipping Rule - The 20% Rule

At Apex Trader Funding, traders must adhere to the 20% Rule, which stipulates that flipping trades—quickly opening and closing a position for minimal profit or loss—cannot exceed 20% of the required ten (10) trading days. In other words, out of the minimum ten (10) trading days needed to qualify for a payout, only two (2) days can be dedicated to flipping trades. This rule underscores the importance of consistent and genuine trading activity, emphasizing the use of standard day-to-day trading systems over strategies aimed at meeting payout deadlines or artificially inflating trading volume.

Apex Trader Funding News Trading - The News Rule

Apex Trader Funding strictly prohibits news trading in any form, including directional trading, straddles, strangles, and exploiting initial news bursts. Engaging in such practices, such as entering trades right before or after news events to capitalize on potential market movements, will result in denial of payout requests. While traders are allowed to execute their normal trading strategies during news times, they must adhere to standard entry rules without engaging in simultaneous long and short positions across multiple accounts. Any involvement in group schemes or partnerships for news trading will lead to account closure, forfeiture of funds, and banning from the Apex Trader Funding platform.

Apex Trader Funding Payout Schedule

At Apex Trader Funding, traders can request payouts twice per month, providing a steady income stream to support their trading endeavors. Here's what you need to know about the payout schedule:

Payouts occur twice monthly, with request windows open from the 1st to the 5th and the 15th to the 20th of each month.

Requests made from the 1st to the 5th may be approved between the 1st and the 14th and paid out by the 15th.

Requests submitted between the 15th and 20th may be approved between the 15th and the 29th and paid out by the 30th.

Just because a payout request has been submitted does not guarantee approval; it could be denied based on various factors.

Once a payout request is submitted, it cannot be altered or cancelled.

Requests will be either approved or denied, and once submitted, traders should trade their accounts as if the requested funds have already been deducted.

If payout status is pending, and the account balance falls below the minimum required for withdrawal, the request will be automatically denied.

In the event of a blown account, pending payouts will not be issued, but if a payout request has been approved before the account is blown, the trader will still receive the approved amount.

If approved, traders will first receive an email confirming the approval. Once processed, another email will be sent indicating the payout has been sent, followed by 3 to 7 business days for funds to reach the bank.

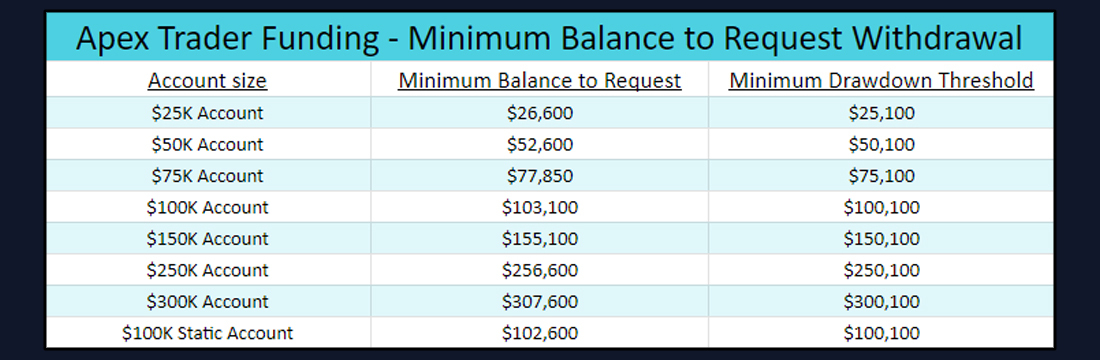

Apex Trader Funding Minimum Balance to Request Withdrawal

To request a withdrawal from your performance account at Apex Trader Funding, ensure your account meets the minimum balance requirement for payout approval. In a performance account, the Trailing Drawdown stops at the starting balance plus $100.

Unlike other platforms, you're not required to maintain a "safety net" amount in your account. For example, if you possess a $50,000 account, a balance of $52,600 is necessary to request a payout, enabling you to withdraw up to $2,000. However, your remaining balance after withdrawal must not dip below the minimum drawdown threshold of $50,100 to avoid "blowing" the account. It is imperative to note that regardless of being the initial or subsequent payout, a balance of at least $52,600 is essential to qualify for withdrawal from a $50,000 account at Apex Trader Funding.

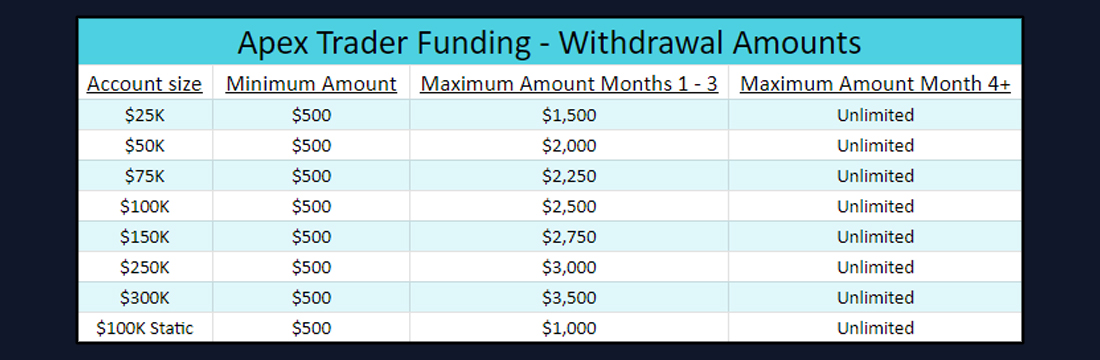

Apex Trader Funding Withdrawal Amounts

At Apex Trader Funding, the withdrawal amounts have been tailored to accommodate your needs while ensuring financial stability. During the first three months, there are some limits in place: the minimum you can withdraw is $500, regardless of account size. The maximum withdrawal amount, on the other hand, is determined based on the size of your account, outlined in the table below. You're allowed to withdraw up to this maximum amount twice a month, offering flexibility while maintaining a structured approach. Transitioning into month four and beyond, the constraints relax significantly; while you still can withdraw only twice per month, there’s no longer a cap on the amount, granting you greater freedom to access your funds as needed.

Apex Trader Funding Payout Checklist

To ensure you're eligible for a payout with Apex Trader Funding, we have crafted a convenient payout checklist just for you. Before initiating the withdrawal process, take a moment to review the below questions. This checklist is designed to guide you through the necessary criteria and conditions, ensuring that all your bases are covered.

Have you passed the Evaluation account and began trading in a Apex Trader Funding Performance Account?

Have you placed a trade on a minimum of 10 trading days?

Does your account meet the 30% Rule Consistency guidelines?

Does you account meet the 20% Rule Flipping guidelines?

Have you steered clear of trading any economic news events?

Is it the 1st - 5th or 15th - 20th of the month?

Have you met the minimum balance to request a withdrawal?

If you answered "yes" to all seven (7) questions, congratulations! You meet all the necessary criteria to submit a Payout Request with Apex Trader Funding.

The content of this article is based on resources from the Apex Trader Funding website.

Nexgen ProTrader Funding Evaluation Questions Answered

A complete breakdown of how the Nexgen ProTrader Funding evaluation works, covering account sizes, drawdown mechanics, trading rules, platforms, and what happens after you pass.

Best Nexgen ProTrader Funding Discount Code

Complete guide to the SOPF discount code for Nexgen ProTrader Funding. Learn how to save up to 90% on evaluations, when sales run, and how to apply the code.

Best Alpha Futures Discount Code

Save on Alpha Futures evaluations with discount code SOPF. Complete pricing breakdown for all plans, activation fee details, step-by-step application guide, and promotional calendar. Get the best deal on your trading evaluation.